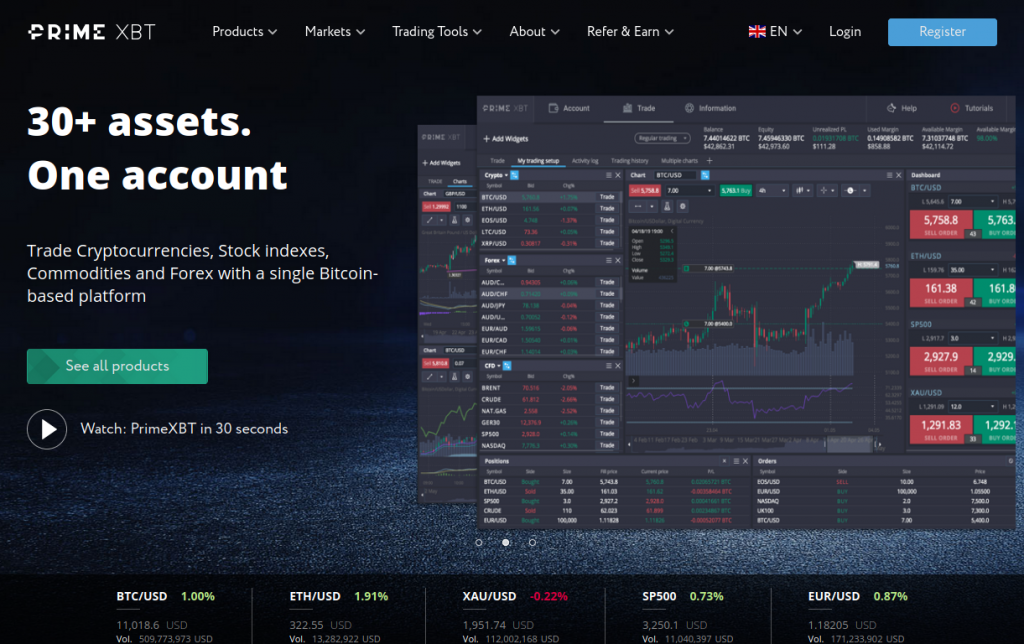

Exploring Global Trading Opportunities Through Countries PrimeXBT

In the realm of financial markets, understanding how different countries interact with platforms like PrimeXBT is critical. Each nation has its unique regulations, economic conditions, and cultural attitudes toward trading and cryptocurrency. This article delves into the nuances of global trading and the factors that influence the PrimeXBT trading experience. For detailed country-specific insights, visit Countries PrimeXBT Countries PrimeXBT.

The Role of Countries in Shaping Trading Platforms

Countries play a crucial role in shaping financial markets through their regulations, economic policies, and technological advancements. The nation’s approach to cryptocurrencies and trading often dictates how local traders interact with platforms like PrimeXBT. Factors such as government regulation, taxation, and access to technology significantly impact the trading experience.

Regulatory Landscape Across Different Countries

Regulation is one of the foremost aspects that determines how a trading platform operates in various regions. For instance, in countries like the United States, regulations are strict and vary from state to state. The Securities and Exchange Commission (SEC) closely monitors cryptocurrency transactions to protect investors from fraud. In contrast, countries such as Malta have embraced cryptocurrencies, creating a regulatory environment that encourages innovation and attracts blockchain companies.

Similarly, in regions like Asia, the regulatory landscape is diverse. Japan has established a regulatory framework that requires cryptocurrency exchanges to register with the Financial Services Agency (FSA). This balance of regulation fosters a secure trading environment, which in turn boosts investor confidence. On the other hand, countries like China have imposed strict bans on cryptocurrency trading, pushing many traders into the arms of decentralized exchanges or foreign platforms like PrimeXBT.

Economic Conditions and Their Impact on Trading

The economic climate of a country greatly influences how trading behaves. For instance, in stable economies with strong currencies, traders might feel more comfortable using leverage in their trades. Conversely, in countries facing economic crises or high inflation, such as Venezuela, traders might turn to cryptocurrencies as a safeguard against currency devaluation.

Political stability also plays a significant role. Investors from politically stable countries are more likely to invest in innovative platforms like PrimeXBT, engaging in cryptocurrency trading and derivatives, while those in less stable regions might adopt a more cautious approach. These economic and political factors not only determine the volume of trading but also the type of assets that traders are willing to engage with.

Cultural Influences on Trading Practices

Cultural attitudes towards investment and trading can significantly affect how countries engage with platforms like PrimeXBT. In cultures where risk-taking is more accepted, such as in the United States, individuals might be more inclined to participate in high-risk trading strategies, including leveraged tokens offered by PrimeXBT. Alternatively, in cultures that value caution and financial conservatism, individuals may favor stability and long-term investments over speculative trading.

Moreover, educational background and financial literacy play pivotal roles in shaping how people interact with trading platforms. Countries with a strong emphasis on financial education often see higher participation rates in trading activities. In contrast, regions lacking financial literacy may witness a hesitancy towards engaging in complex trading practices, which can limit market growth and volatility.

Technological Advancements and Accessibility

The availability of technology is a major factor that enhances the trading capabilities of individuals in various countries. In technologically advanced countries such as South Korea and Japan, traders often enjoy quick access to sophisticated trading platforms like PrimeXBT, along with superior Internet connectivity. These conditions facilitate faster transactions and more informed decision-making, positively impacting the overall trading experience.

On the flip side, countries with limited technological infrastructure may pose challenges for traders. Slow Internet speeds, lack of access to mobile devices, and poor cybersecurity measures can deter potential users from engaging with crypto trading platforms. However, as technology continues to evolve and become more accessible worldwide, we can anticipate an increase in global participation in trading activities.

The Future of Trading with Countries PrimeXBT

The future of trading with PrimeXBT and other similar platforms will depend largely on the evolving regulatory frameworks and technological advancements across different countries. As more nations start recognizing the potential of cryptocurrencies and blockchain technology, we can expect a more harmonious regulatory environment that encourages innovation while protecting investors.

Furthermore, the increasing globalization of financial markets coupled with the rise of DeFi (Decentralized Finance) solutions will likely lead to a transformation in how traders interact with platforms like PrimeXBT. We are already witnessing a trend where traditional financial assets and cryptocurrencies are converging, offering traders unique opportunities and diversified options for investment.

Conclusion

In conclusion, the intersection between countries and platforms like PrimeXBT illustrates a complex but fascinating trading landscape influenced by regulations, economic conditions, cultural attitudes, and technology. Understanding these dynamics is crucial for traders seeking to navigate the global markets effectively. As the trading landscape continues to evolve, so too will the opportunities it presents. Embracing these changes while remaining informed about the specific conditions in various countries will empower traders to make more informed decisions and capitalize on emerging opportunities.